Thailand Subscription Box Market 2026-2032: Price, Share, Trends & Growth Analysis – The Report Cube

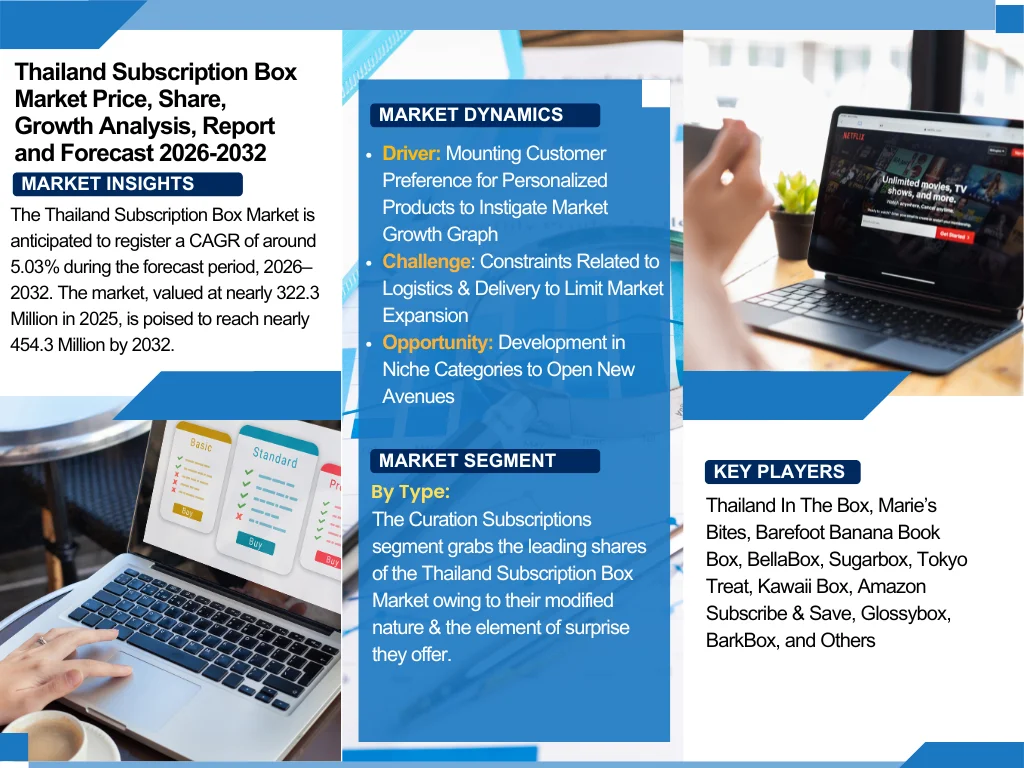

The Report Cube which is one of the leading market research company in UAE expects the Thailand Subscription Box Market to grow at a CAGR of around 5.03% through 2032, as highlighted in their latest research report. The study provides an in-depth analysis of the emerging trends shaping the Thailand Subscription Box Market and offers detailed forecasts for its potential growth during 2025–2032. The report also presents a comprehensive assessment of the competitive landscape, including profiles of leading players, their performance metrics, and recent strategic developments. Additionally, it explores the key market drivers, challenges, opportunities, and provides insights into historical and future revenue trends at the global, regional, and country levels.

Thailand Subscription Box Market Overview:

Market Size (2025): USD 322.3 Million

Market Size (2032): USD 454.3 Million

CAGR (2025–2032): 5.03%

Top Companies in Thailand Subscription Box Market: Thailand In The Box, Marie’s Bites, Barefoot Banana Book Box, BellaBox, Sugarbox, Tokyo Treat, Kawaii Box, Amazon Subscribe & Save, Glossybox, and BarkBox

Request a Free Sample PDF of This Report - https://www.thereportcubes.com/request-sample/thailand-subscription-box-market

Thailand Subscription Box Industry Recent News and Developments:

Thailand in The Box introduced a special "Essence of Thai Herbs Box" in February, aiming at customary or traditional Thai wellness products & teas, pursuing both local customers & the global Thai diaspora.

Barefoot Banana Book Box joined hands with the Ministry of Education, Thailand, to promote a subscription box model for schools, encouraging bilingual children’s literature across urban & semi-urban areas.

Key Growth Drivers of the Thailand Subscription Box Market:

People across the nation are progressively inclined toward personalized experiences, which is resulting in driving the Thailand Subscription Box Market demand. Subscription boxes provide the perfect blend of customization & surprise, specifically in beauty & food segments. Also, companies deploy AI & customer feedback to style boxes as per individual preferences. For instance, Marie’s Bites allows users to opt for dietary preferences, allergy filters, and snack types, making their Thailand snack subscription box more desirable & customer-friendly. Further, this high degree of personalization is improving customer retention & acquisition, instigating the market expansion.

Thailand Subscription Box Market Segmentation

The market is segmented based on application, type, gender, and competitors to provide a comprehensive understanding of consumer preferences and industry dynamics. By application, the market spans categories such as Clothing & Fashion, Beauty, Food & Beverages, Pet Food, Baby Products, Health & Fitness, and others. In terms of subscription type, it includes Replenishment, Curation, and Access models. Gender-based segmentation distinguishes between male and female consumers, while competitor analysis highlights key market players, their competitive characteristics, and revenue shares. This segmentation framework enables targeted strategies and informed decision-making for stakeholders.

By Application:

· Clothing & Fashion

· Beauty

· Food & Beverages

· Pet Food

· Baby Products

· Health & Fitness

· Others

By Type:

· Replenishment Subscription

· Curation Subscription

· Access Subscription

Gain complete insights into market segmentation, key trends, and forecasts by accessing the full report - https://www.thereportcubes.com/report-store/thailand-subscription-box-market

By Gender:

· Male

· Female

Note:

If you need additional data points, insights, or specific information not covered within the current scope of this report, we are pleased to offer customized research support. Through our tailored customization service, we can gather and deliver the exact information you require aligned with your unique objectives and business needs. Simply share your requirements, and our team will ensure the report is updated accordingly to meet your expectations with precision and accuracy.

Contact Us - https://www.thereportcubes.com/contact-us

About The Report Cube

The Report Cube is a leading provider of market research and business intelligence solutions in UAE, dedicated to helping organizations make smarter, data-driven decisions. With a comprehensive library of over 900,000 industry reports covering 800+ sectors worldwide, the company delivers precise insights, actionable forecasts, and strategic recommendations tailored to client objectives.

Backed by a team of 1,700+ experienced analysts and researchers, The Report Cube empowers businesses with the knowledge they need to navigate evolving markets, identify opportunities, and sustain growth in an ever-changing global landscape.

The company specializes in syndicated research, customized studies, competitive analysis, company profiling, and industry forecasting, serving clients across industries including energy, technology, healthcare, manufacturing, and more.

For more information, visit www.thereportcubes.com.

Burjuman Business Tower, Burjuman, Dubai

- Art

- Causes

- Crafts

- Dance

- Drinks

- Film

- Fitness

- Food

- Games

- Gardening

- Health

- Home

- Literature

- Music

- Networking

- Other

- Party

- Religion

- Shopping

- Sports

- Theater

- Wellness